how much does nc tax your paycheck

In North Carolina The state income tax in North Carolina is 525. There is a flat income tax rate of 525 which means no matter who you are or how much you make this.

Paycheck Calculator North Carolina Nc Hourly Salary

North Carolina payroll taxes are as easy as a walk along the outer banks.

. Rates can be as low as 006 or as high as 576. It is a flat rate that is unchanged. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions.

No state-level payroll tax. Those are the headlines nationally but the fine print here in North Carolina is that youll pay 525 in taxes on each 10000 in debt relief money. For tax year 2021 all taxpayers pay a flat rate of 525.

Our calculator has recently been updated to include both the latest Federal. North Carolina moved to a flat income tax beginning with tax year 2014. 9 rows the income tax is a flat rate of 499.

4 rows Divide the total of your tax deductions by your total or gross pay. Therefore it will deduct only the state income tax from your paycheck. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

To pay this tax each quarter you will complete the Employers Quarterly Tax and Wage Report to report wage and tax information. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income. Just enter the wages tax withholdings and other information required.

Skip to main content. Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. That rate applies to taxable income which is.

Overview of North Carolina Taxes North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. In North Carolina youll pay 525.

The tax credit is only available to employers who pay the state unemployment tax regularly and in full. State and Local Payroll Taxes The state income tax of 525 applies to all wages in North. There is a flat income tax rate of 499 which means no matter who you are or how much you make.

For tax years 2015 and 2016 the north carolina individual income tax rate is 575 00575. Multiply the result by. Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent.

North Carolina payroll taxes are as easy as a walk along the outer banks.

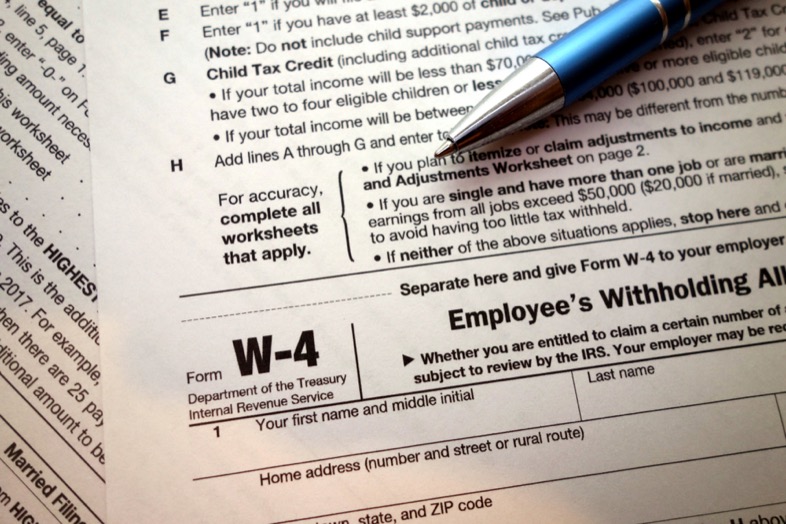

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

Hourly Paycheck Calculator Nevada State Bank

New Federal Tax Withholding Tables Nc Osc

North Carolina Paycheck Calculator Tax Year 2022

Income Tax By State What S Your Take Home Pay On 100 000 Salary

Taxes Spending Payroll Deductions 4 01 Explain Taxes On Income Ppt Download

New Tax Law Take Home Pay Calculator For 75 000 Salary

How To Complete Your Nc Withholding Allowance Form Nc 4 Youtube

New W 4 Irs Tax Form How It Affects You Mybanktracker

How To Calculate North Carolina Income Tax Withholdings

Solved Assuming That Hope Receives A Paycheck At Chegg Com

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

North Carolina Paycheck Calculator Smartasset

Irs Announces Tax Inflation Adjustments Why Your Paycheck Could See A Bump Fox8 Wghp

Here S How Much Money You Take Home From A 75 000 Salary