cap and trade vs carbon tax canada

Economic guru and former Federal Reserve Chairman Alan Greenspan has come out against cap and trade as an effective mechanism for reducing carbon emissions. In cap-and-trade the government sets a.

Economist S View Carbon Taxes Vs Cap And Trade

Carbon pricings costs and.

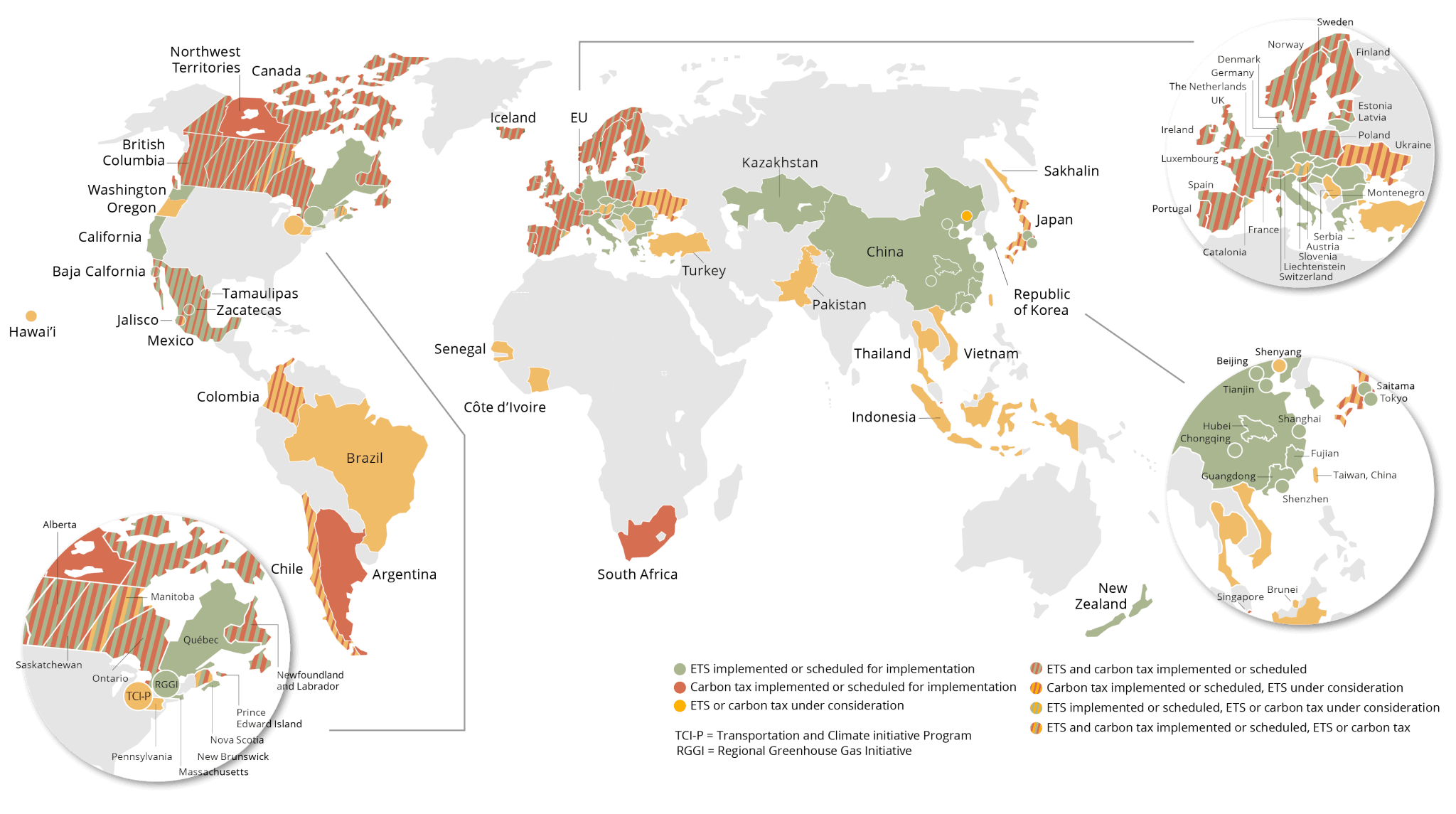

. The first is a carbon tax which sets a price on carbon directly and lets individuals and companies decide how much carbon to produce. Quebec and Nova Scotia use cap-and-trade systems and Newfoundland and Labrador will raise its price to 50 a tonne later in 2022. A carbon tax and cap-and-trade are opposite sides of the same coin.

A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. Cap and trade and Saskatchewan opposes carbon pricing. See Appendix B for more information.

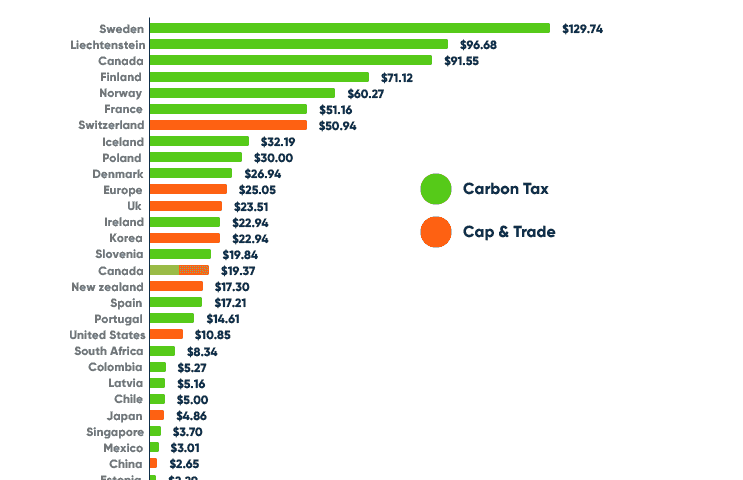

Carbon taxes vs. That cap and trade systems play in some of the provincial plans this paper on cap-and-trade systems appears timely5 4 Framework page 49. The carbon tax is a financial measure of the actual cost of greenhouse gases and its impact on the economy Carbon Tax or Cap-and-Trade 2014.

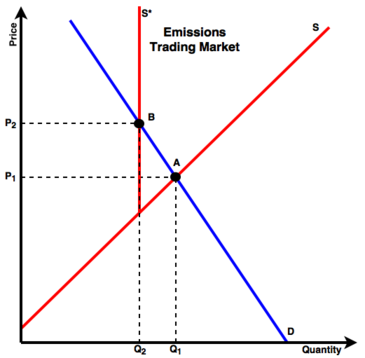

The second is cap and trade which sets the maximum quantity. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. With a tax you get certainty about prices but uncertainty about emission reductions.

With regards to which. Cap and Trade. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

A carbon tax and cap-and-trade system complement each other ensuring there is a price on CO2 emissions across the entire economy given that a cap-and-trade system typically covers large stationary sources of emission at the production end while a carbon tax addresses the consumption end. Emissions trading or cap-and-trade CAT and a carbon tax are fundamentally different tools to limit the effects of using fossil fuels. Each approach has its vocal supporters.

A carbon tax will be applied to gas diesel and natural gas but large emitters will face additional measures. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some supporting carbon taxes and others favoring cap-and-trade mechanisms. Alberta is emulating BC.

Cap-and-trade raises the prices of consumer goods and services as opposed to a carbon tax which is essentially a sales tax or a tax on consumption. Before the policy the intersection of the supply and demand curves for. Cap and Trade vs.

To a first approximation cap-and trade is the equivalent of a carbon tax. On the other hand political economy forces strongly point to less severe tar - gets if carbon taxes are used rather than cap-and-trade which is why envi-ronmental NGOs are opposed to the tax approach. The regulatory authority stipulates the.

I have grave doubts that international agreements imposing a globalized so-called cap-and-trade system on CO2 emissions will prove feasible he wrote in his recent book The Age of. How do the two major approaches to carbon pricing compare on relevant dimensions including but not limited to. Theory and practice Robert N.

Carbon Tax vs. You can do the same to cap-and-trade. With a cap you get the inverse.

Economists usually prefer taxation over quality controls due to incentives such as the continual motivation to reduce consumption on the taxed pollution Brander 2014 p. The Ontario Divisional Court concluded that the Ontario government was obliged under the Environmental Bill of Rights to engage in public consultation prior to terminating the carbon pricing system implemented by the Liberal government. 5 Another recent government commitment to carbon pricing is the Ontario governments decision to institute a cap and trade system effective January 1 2017.

Carbon tax the price of carbon or of CO 2 emissions is set directly by the regulatory authority this is the tax rate. Here is the Econ 101 version of how the two work. With a carbon tax Ontario and Quebec favour.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. Carbon tax vs emissions trading.

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. If the European Unions Emission Trading Scheme ETS accomplishes. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so.

Both can be weakened with loopholes and favors for special interests. Political reality being what it is either is likely to impose a fairly low. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism.

Heres a primer on carbon taxes and cap and trade in Canada. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at. In contrast under a pure cap-and-trade system the price of carbon or CO 2 emissions is established indirectly.

There is a debate over which policy is best to moderate the use of fossil fuels and limit carbon emissions and pollution as a result of the combustion of these fuels for electrical generation and other uses. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways.

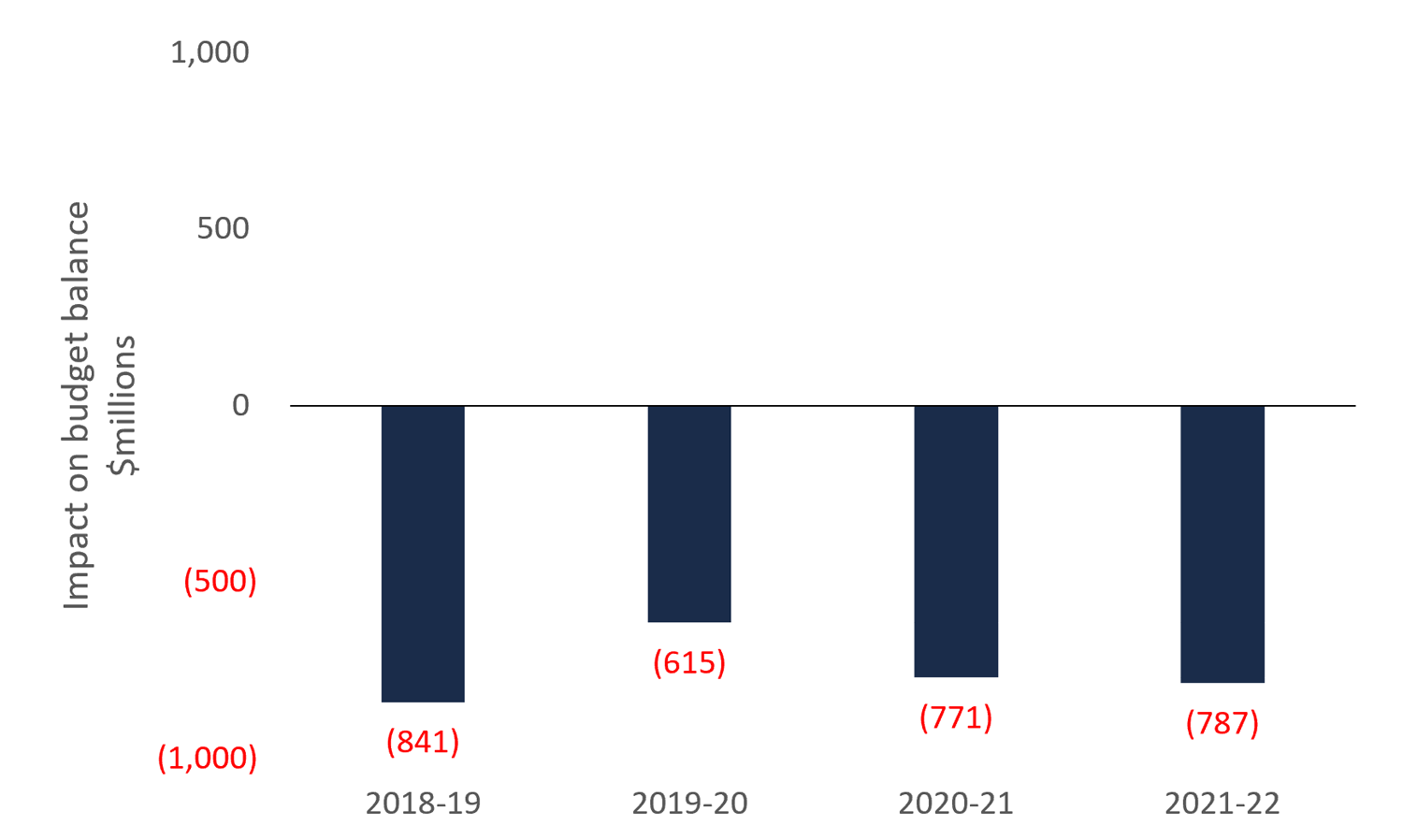

Peter MacdiarmidGetty Images G r. You can tweak a tax to shift the balance. The claim against the repeal of the cap-and-trade regime was filed in 2018 by Greenpeace Canada.

Difference Between Carbon Tax And Cap And Trade Difference Between

Cap And Trade Basics Center For Climate And Energy Solutions

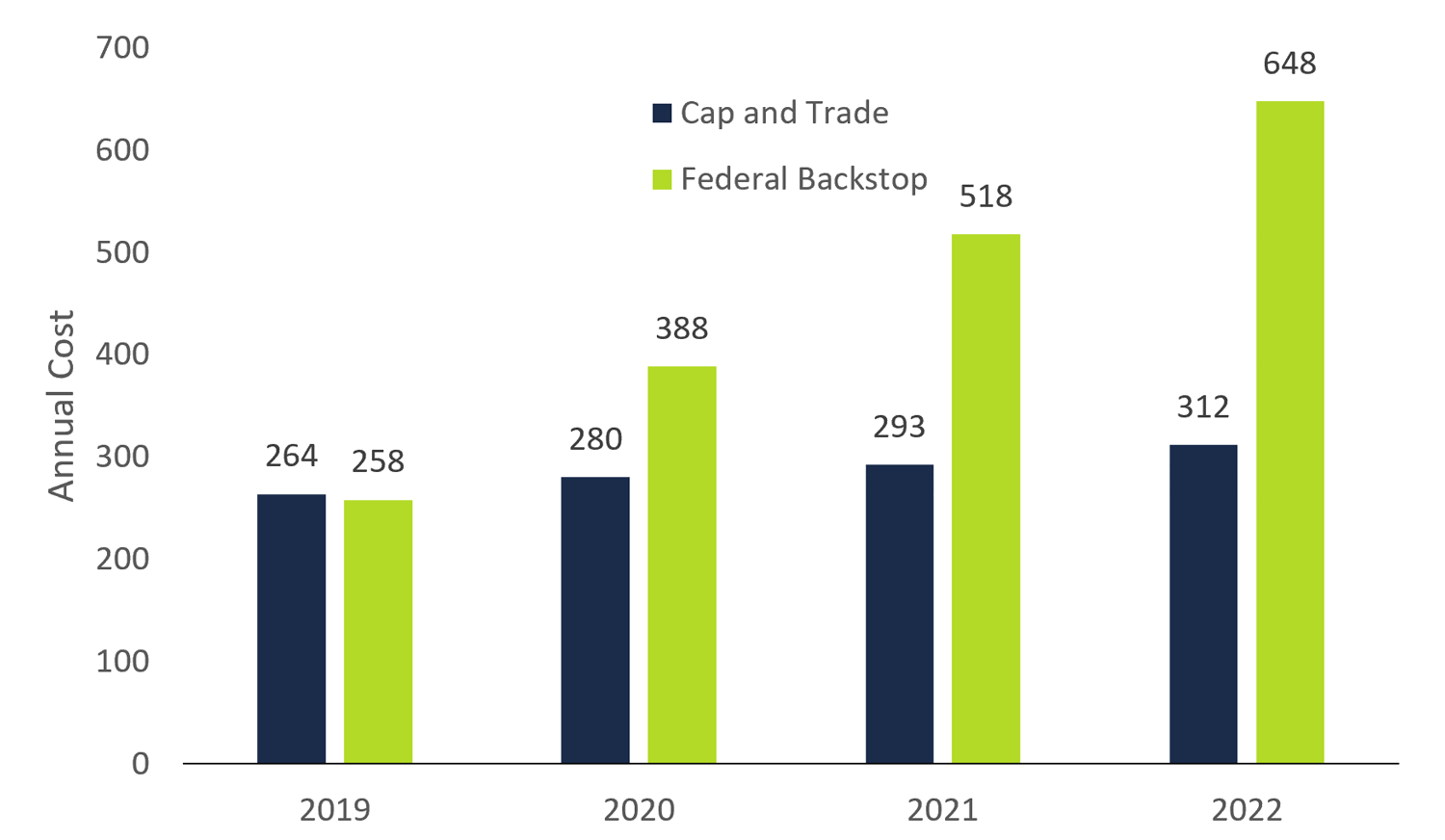

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

Carbon Markets Putting A Price On Carbon Green City Times

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax Vs Emissions Trading Energy Education

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Difference Between Carbon Tax And Cap And Trade Difference Between

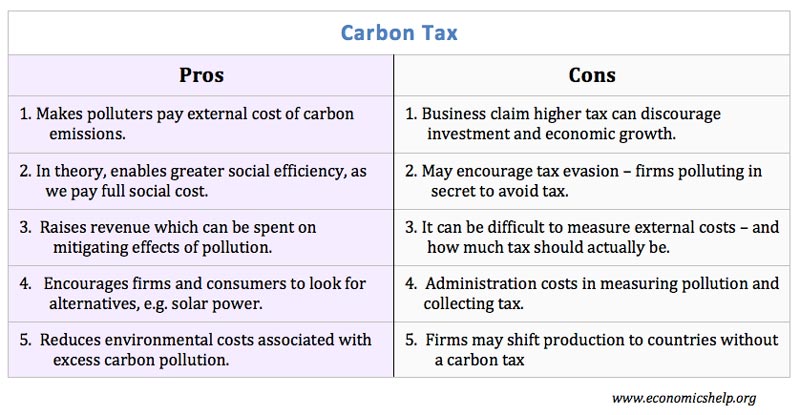

Carbon Tax Pros And Cons Economics Help

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Difference Between Carbon Tax And Cap And Trade Difference Between

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca